一份對澳大利亞超市茶葉品牌排名的研究調(diào)查報告展示了對全球茶葉商品化發(fā)展的趨勢,促進了茶葉袋的受歡迎程度,并證明了技術在日常用品進行實用性比較中的力量。

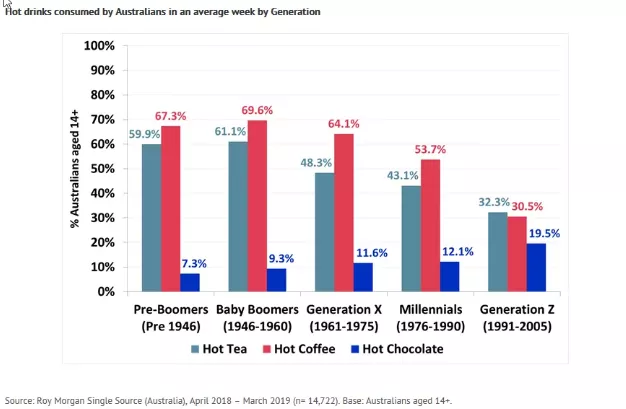

Australians favor tea. Half of the population (9.8 million tea drinkers among a population of 24.6 million) drink at least one cup of tea weekly. Australians drink an averages 9.5 cups per person per week with young people consuming 5.5 cups per week on average and those 65+ drinking 10.9 cups per week according to Roy Morgan Research. While only 32% of those aged 14-17 drink tea weekly, that percentage climbs to 61% for their parents (born 1961-75) and to 61% for their grandparents (born 1946-60). Consumption per capita is estimated at 1.5 lbs. (0.7 kg) in 2019.

澳大利亞人鐘愛茶。將近一半澳大利亞人(2460萬人口中有980萬飲茶)每周至少喝一杯茶。根據(jù)羅伊·摩根研究(RoyMorganResearch)公司的數(shù)據(jù),澳大利亞人平均每人每周喝9.5杯茶,年輕人平均每周喝5.5杯,而65歲以上的人每周平均要喝10.9杯。在14-17歲的兒童中,有32%的人每周喝茶,而父母這一輩(1961-75年出生)中這一比例攀升至61%,祖父母這一輩人(1946-60年出生)的比例攀升至61%。預計2019年澳大利亞人均茶葉消費量為1.5磅(0.7公斤)。

In America iced and ready-to-drink dominate and unlike Australia, millennials are the largest tea consumers. Only 1 million Australians (5%) drink iced tea weekly and 1.1 million drink iced coffee, according to Roy Morgan Single Source 2019. Australians born between 1976-1990 drink hot coffee (54%). Hot drinks are consumed by 15.2 million Australians weekly. Both the U.S. and Australia are witnessing soft prices and a decline in demand for commodity teas. “Coffee is growing its lead,” according to Roy Morgan. During the years 2014-18 Australia added 1 million coffee drinkers, compared to 300,000 new tea drinkers.

與冰飲和即飲飲料占主導地位且千禧一代是最大茶葉消費者的美國不同,根據(jù)羅伊·摩根(RoyMorganSingleSource)2019年數(shù)據(jù),在澳大利亞,每周只有100萬澳大利亞人(5%)喝冰茶,110萬喝冰咖啡。而1976年至1990年之間出生的澳大利亞人喝熱咖啡(54%)。每周有1520萬澳大利亞人消費熱飲。美國和澳大利亞都在經(jīng)歷對商品茶的需求下降以及茶葉價格疲軟問題。根據(jù)羅伊·摩根(RoyMorgan)所說:“咖啡正在擴大領先優(yōu)勢。”在2014-18年度,澳大利亞新增了100萬咖啡飲用者,相比之下,只新增加了30萬茶葉飲用者。

The Australian tea market is valued at $1.2 billion and is growing at a compounded rate of 3.5% through 2023, according to Statista, a German-based market research firm. Packaged tea is valued at $324 million annually. Tea revenue per capita is $46.99, most of which is spent at supermarkets. Since teabags sell for 3- to 10-cents each, this is roughly equivalent to 10 boxes of 100-count tea annually. All those boxes add up to the 10,500 metric tons sold in grocery stores last year. There is a lively but much smaller specialty tea segment represented by T2, founded in Melbourne in 1996, acquired by Unilever in 2013 and now global with 110 outlets. In grocery, T2 teabags sell for an average 48-cents each.

根據(jù)總部位于德國的市場研究公司Statista的數(shù)據(jù),澳大利亞茶業(yè)市場的價值為12億美元,并且在2023年以前將以3.5%的復合增長率增長。袋裝茶(Packagedtea)的市場價值為每年3.24億美元,人均袋裝茶葉支出為46.99美元,其中大部分消費在了超市,由于袋泡茶的平均售價在3-10美分之間,也就是相當于每人每年要消費10盒(每盒100袋)的袋裝茶。去年,在雜貨店市場售出袋裝茶達10500噸。例如,年輕但比較小眾的特種茶品牌代表T2——一家1996年成立于墨爾本,并于2013年被聯(lián)合利華(Unilever)收購的茶葉企業(yè),目前在全球擁有110個營業(yè)網(wǎng)點,在雜貨店中,T2袋裝茶平均售價為48美分。

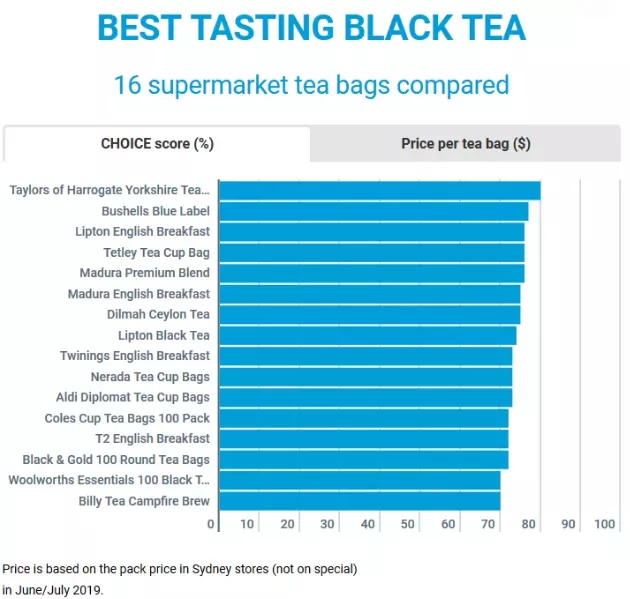

Choice, a respected consumer advocate offering advice free of commercial bias, evaluated 16 bagged teas, subjecting each to a blind tasting by 62 tea drinkers and delving into the origin, format and calculating pricing by unit. Samples were drawn from stores in Sydney. Testing was completed in June and July 2019 and the interactive report was published last month.

Choice——一 家致力于提供無商業(yè)偏見建議的消費者權益網(wǎng)站,在6月和7月,從悉尼商店抽取了16種袋裝茶,邀請62位飲茶者對每種茶進行了盲品,并研究了每種茶的產(chǎn)地、加工形式和單價,并在上個月發(fā)布了報告。

The Choice website is an extension of a consumer products magazine launched in the 1950s. Evaluations are extensive and typically focused on common consumer products and services. These include appliances such as refrigerators and vacuum cleaners, consumer electronics and services such as those offered by banks and insurance companies. The venture is non-profit, financed by members and similar to US-based Consumer Reports. Members pay $18.50 per quarter (AUS$26.95) to subscribe.

Choice 網(wǎng)站是上世紀50年代發(fā)行的《消費品》雜志的延伸,其所評估的內(nèi)容十分廣泛,通常側重于普通消費產(chǎn)品和服務,包括冰箱和吸塵器等電器,電子產(chǎn)品以及銀行和保險公司提供的服務等。該機構是非營利性的,由會員提供資金,類似于美國的《消費者報告》(ConsumerReports),會員每季度支付18.50美元(26.95澳元)進行訂閱。

In October Choice published a buying guide titled: What’s the best tasting black tea? The report excluded loose leaf, ready-to-drink teas and herbals, concentrating on the most common tea in Australia – black tea in bags (tagged, tagless and round). All the majors were evaluated including global leaders Yorkshire, Lipton, Tetley, Twinings and Dilmah as well as national brands including Bushells Blue Label, Madura and Billy Tea Campfire Brew.

在10月,Choice推出了一份購買指南,標題為:喝起來最好的紅茶是什么?該報告不針對散葉,即飲茶和花草茶,而是集中于澳大利亞最常見的茶-袋裝紅茶(帶標簽,無標簽和圓形)。評估包含了所有主要品牌,包括全球領導者約克郡(Yorkshire)、立頓(Lipton)、特特利(Tetley)、川寧(Twinings)和帝瑪(Dilmah),以及包括BushellsBlueLabel,Madura和BillyTea Campfire Brew在內(nèi)的澳大利亞本地品牌。

The winner with a score of 80% was Taylors of Harrogate Yorkshire Proper Black Tea, a British-inspired blend packaged in the United Arab Emirates. Close at heel were Bushells Blue Label (77%) and Lipton English Breakfast (75%); Tetley (76%) and Madura Premium Blend (76%) complete the top five.

冠軍是TaylorsofHarrogateYorkshireProperBlackTea(80%),這是一種英國風格的在阿聯(lián)酋包裝的混合茶,緊隨其后的是BushellsBlueLabel(77%)和LiptonEnglishBreakfast(75%);Tetley(76%)和MaduraPremiumBlend(76%)也排在前五。

Results take into consideration taste and value. While Twinings (priced at 11-cents per teabag) is Australia’s best-selling tea, it scored 73% (below the 75% threshold for a Choice Recommendation). Yorkshire Tea (priced at 5-cents per tea bag) was rated the best tasting. One reviewer called it a “dark tea with a strong flavor. Very pleasant and smooth aftertaste.”

綜合考慮口感和價格。盡管Twinings(每袋11美分)是澳大利亞最暢銷的茶葉,但它的得分為73%(低于75%的推薦標準),而約克郡茶(每袋5美分)被評為最美味的茶。一位評論者稱其為“味道濃烈的紅茶,但有著非常柔和的回味。”

When evaluating supermarket brands, price is a primary consideration. The chart shows that commodity brands, like those in the U.S., are closely grouped around 5 cents per teabag. Specialty teabags are 10x more costly.

在評估超市品牌時,價格是首要考慮因素。據(jù)圖表顯示,與美國的商品品牌一樣,每個袋裝茶的價格大約為5美分,而特種茶袋的價格相比要貴10倍。

Individual brands are evaluated for key characteristics including format and origin. The website’s tools for searching and making comparisons are robust. Readers can make side-by-side comparisons for any combination of the 16 brands or see them all together.

對各個品牌進行關鍵特征評估,包括加工方式和產(chǎn)地。該網(wǎng)站用于搜索和進行比較的工具功能十分強大,消費者可以對16個品牌的任意組合進行并排比較,也可以一起查看。

Consumers in-store can also call up an abbreviated list by brand.

店內(nèi)消費者還可以按品牌調(diào)出評估簡述。

Roy Morgan CEO Michele Levine observes that “although consumers of both hot tea and iced tea are more likely to be women than men, the average hot tea drinker is likely to be prosperous, well-educated and living in an older household from which the kids have moved out.” In contrast, more than half the iced tea market is consumed by people under 35 years of age and concentrated in the youngest generation – Gen Z, she said.

羅伊·摩根(RoyMorgan)首席執(zhí)行官米歇爾·萊文(MicheleLevine)指出:“從性別來說,熱茶和冰茶的消費者都更有可能是女性;另外熱茶飲用者更可能是相對富裕、受過良好教育并且生活在沒有小孩的老房子中。”她說,相比之下,超過一半的冰茶市場是由35歲以下的人消費的,并且集中在最年輕的一代–Z世代。